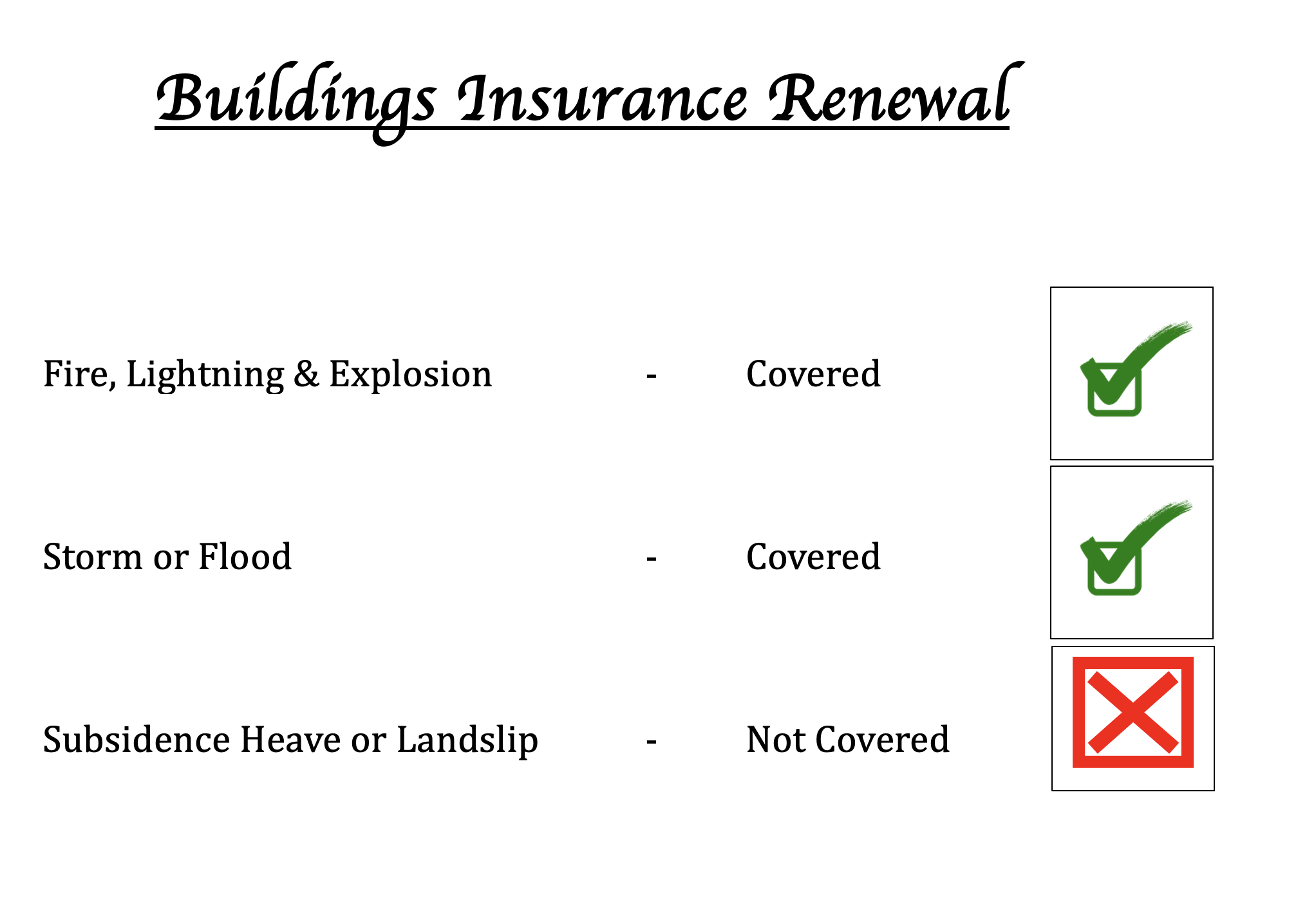

The landscape of subsidence insurance is dramatically changing – and rapidly. This is because subsidence is costing the insurance industry a rising fortune and they need to do something to address that – so they are taking steps to avoid higher-risk subsidence cases. Perhaps soon cover for subsidence will become a thing of the past altogether? It is not offered in most other countries anyway so that would bring the UK more in step with the rest of the world (see https://bandsc.co.uk/is-the-uk-out-of-step-with-the-rest-of-the-world-on-subsidence/).

The UK first introduced cover for subsidence in the early 1970s and it quickly became a standard peril, required by lenders before they would give a mortgage. Homeowners have been making subsidence claims in droves and the insurers have paid billions out. It used to be the normal thing to do when cracks appeared – to reach for the insurance policy. Not so much any more.

Climate change has led to a significant increase in the frequency of hot dry summers, and correspondingly incidents of clay shrinkage subsidence, and the overall cost to the insurance sector is now immense. 2025 is proving to be a record year for subsidence but this time many homeowners are choosing not to involve their insurers, and deal with the matter themselves instead. It is usually easy enough to do with a little guidance, and costs are not usually too high if the damage is minor (which it usually is). In the case of third-party trees, with a full portfolio of sound technical evidence and good legal argument, costs can even in some circumstances be recovered from the third party (or their liability insurer).

The reason that homeowners are choosing not to involve their insurers is that those insurers are frequently now withdrawing subsidence cover at renewal if you have made a claim. Some insurers are now even excluding subsidence cover on any property which has ever had a subs claim! Many people would now rather not raise their heads above the parapet and would prefer to lose the opportunity to claim for any escalation in damage, than risk the insurer withdrawing subsidence cover at renewal. Rightly or wrongly, this is often the train of thought. In some cases though, they could be jeapordising their insurance cover by doing so – and any claim they make might result in their policy being voided from inception.

Whilst the 2012 Act CIDRA modifies the principle of “Utmost Good Faith” by removing the previous duty of consumers to volunteer “material facts” not specifically required to disclose by the insurer, it is still your responsibility to take reasonable steps not to make a misrepresentation. You should check your specific policy wording carefully, and read proposal / statement of facts and renewal questions carefully, answering honestly and reporting any change of the facts initially advised at inception.

Underwriting of subsidence risks has also changed dramatically recently, with a variety of computer-based risk assessment tools such as BGS’ Property Subsidence Assessment tool, and the National Tree Map. Such recently-developed tools help Underwriters identify some of the higher risk subsidence sites and rate premiums / excesses accordingly – in some cases not even offering subsidence cover at all, or offering renewal without it – even if there has been no report of cracking at the property.

Subsidence Blight

A history of subsidence puts both buyers and insurers off getting involved with a property. That devalues the property significantly, but the effect is not necessarily permanent – the longer the property has remained stable after mitigation of the cause and repairs are effected, the less the devaluing effect. It has been suggested that a property will regain its proper value after about 10 years of proven stability, and this is reinforced by some insurers who are now only offering subsidence cover if 10 years of stability can be demonstrated. The withdrawal of subsidence cover by insurers sends out a strong message – “this property is too high a subsidence risk for us”, and other insurers may discover that the cover was withdrawn via the Claims & Underwriting Exchange database (see below), or by honest disclosure at inception. All insurers ask (at policy inception) whether insurance cover has ever been withdrawn, refused etc. in the past, and to answer that incorrectly risks the policy being voided from inception – and any claim for any matter being rejected (even non-subsidence ones). Proper disclosure of past withdrawal of subsidence cover is likely to result in refusal of the insurance (or at least of the subsidence cover) unless the insurer can be persuaded that the risk is not in fact a high one any more.

Some insurers try to be fair to customers by warning in advance that they will not be renewing subsidence cover – to give them an opportunity to find alternative insurance elsewhere and avoid the withdrawal of cover ever taking place. However, if you do make a subsidence claim, you should not readily agree to any settlement which does not include an undertaking by the insurer to continue to offer subsidence cover at normal rates for a period of up to 10 years after mitigation and repairs are completed. Further, that any more subsidence which occurs during that time (by the same cause as the original) should be treated as a continuation of the original claim – without the application of another excess. This would be a statement of confidence by the insurer in the effectiveness and longevity of their mitigation and repair, which should give confidence to other insurers and buyers alike, and help avoid subsidence blight. Unfortunately, many insurers will not readily agree to such undertakings, but it should be part of the claim settlement negotiation process in my view. Insurers are sometimes far too keen on getting a subsidence claim settled quickly and cheaply, and gloss over poor short-term mitigation efforts (particularly those involving third party trees), which they well know will leave a high risk of subsidence happening again. Insurers have a duty to resolve subsidence claims properly and fully, including lasting mitigation as well as permanent repair to the property.

ABI Guidance and Financial Ombudsman decisions

The Association of British Insurers have produced guidance to insurance companies, which says they should continue to provide subsidence cover after the repair is completed – but do not specify for how long. They also recognise that there could be circumstances where continuation of cover is not possible – but that should be rare. Many insurers take this to mean they must not withdraw the cover before the next renewal but they can then do so with impunity. The Financial Ombudsman has heard numerous complaints from people who have had cover withdrawn and in one recent case held that the insurer should maintain cover for a period of 3 years after completion of repairs in order “to provide assurance to other insurers that AXA’s settlement of the claim has provided for a lasting and effective repair.”

Cash Settlements

Where the insurer agrees a cash settlement with the policyholder, it can withdraw subsidence cover straight away – the rationale being that the homeowner might not ever use the money to repair or stabilise the building. It is only when the insurer has arranged or agreed a repair that the ABI say it must continue to offer cover. It is increasingly common to find that insurers are very keen to offer customers cash settlements (without advising them of the consequences of accepting one) and then coming off risk for subsidence after the cash settlement has been agreed. The Financial Ombudsman is disapproving of cash settlements on subsidence claims – and may be critical of an insurer who encourages a customer to accept one without understanding the consequences (i.e. potential withdrawal of subsidence cover).

Claims not recorded as subsidence

Some insurers are reluctant to log a claim as subsidence after a report of cracking. One potential reason for this is that the ABI Guidance on maintaining cover only applies where a subsidence claim is accepted by the insurer. Upon receiving a report of cracking, an insurer can refuse to log it as a subsidence claim then come off cover at next renewal. If they log it as a subsidence claim they are then bound to follow the ABI Guidance (though many still don’t – as can be seen by the number of complaints to the Financial Ombudsman).

The Claims & Underwriting Exchange (CUE)

This is a national database of all claims recorded, which most insurers use when assessing a risk such as subsidence. So, if there is a claim recorded against your property (even from a previous owner), the insurer of a prospective purchaser will probably discover it and may well seek further information or decline to offer subsidence cover. This could dissuade your buyer from proceeding even if you can demonstrate that it has been properly concluded – as they are likely to need subsidence cover for their mortgage. You are legally bound to disclose any subsidence you are aware of to a prospective purchaser (failure to do so could well be regarded as misrepresentation – and lead to a claim against you by them after the sale).

The consequences of withdrawal of subsidence cover

Apart from the obvious one (not being able to claim for damage), and compounding subsidence blight (see above), a buyer will want full insurance cover, and when they discover that subsidence cover was withdrawn (either through you disclosing it to them as you should, or through the CUE database), they might well not be able to get subsidence cover either. Without that, they might not be able to get a mortgage (as most lenders require subsidence cover). You may find your market is restricted to cash buyers / auction sales – where you would get much less for it that on the normal open market.

Also, the withdrawal of subsidence cover may put you in breach of your mortgage conditions (which often require subsidence cover to be in force). Your mortgage company may insist that you pay the significantly increased cost of specialist cover.

The other consequence is a potential vast increase in claims against third-party tree owners. Currently, insurers don’t tend to pursue these because of the ABI Domestic Subsidence Tree Root Claims Agreement (a bit like the old “knock for knock” agreement in car insurance – the “swings and roundabouts” principle). This of course would not apply to home-owners who will be keen to recover whatever they can from whoever they can after having to pay out ££££s for unexpected subsidence caused by someone else failing to manage the growth of their tree sufficiently. These costs might ultimately fall back on the insurance industry as most people have liability cover under their domestic contents policy, and most people have legal expenses cover too so the cost of pursuing / defending these claims would be borne by insurers as well. See below for further discussion on third party liabilities.

So what can be done?

The insurance sector for subsidence is therefore shrinking, and more people are dealing with it themselves – whether by force or choice. There are a few specialist insurers who will offer subsidence cover at a premium (provided they are satisfied that it is no longer ongoing), but it is now the case that an increasing number of mainstream insurers require a long period (10 years or so) of stability to have elapsed since the repair was completed before they offer subsidence cover at normal rates.

One way to avoid these sort of problems is not to look for insurance to cover a high risk, but to seek to manage-out the risk or reduce it to an insurable level. Most clay shrinkage subsidence is completely avoidable by appropriate vegetation management so having a risk assessment carried out by a professional and following the advice given will go a long way to ensuring that you don’t get subsidence in the first place. See the following blog; https://bandsc.co.uk/avoiding-subsidence-risk-assessments-advice-on-avoiding-clay-subsidence/.

A reassessment could then be made after the recommended action has been taken and a follow-up report given confirming that a high risk had then been reduced to low. With this, insurance should be easier and cheaper to obtain, or withdrawn cover perhaps reinstated.

Also, read carefully the questions asked at inception and again at renewals, and answer truthfully. Avoid going with any insurer who wont offer cover on any property which has any cracks at all (even cosmetic ones). see the following blog;

https://bandsc.co.uk/should-i-disclose-that-minor-plaster-crack-to-my-buildings-insurer/

What about when it’s due to trees not on my land?

When it comes to third-party trees clearly you have no right to manage those, but a professional risk assessment report highlighting a risk (backed by technical evidence where appropriate) should go a long way towards persuading the third party to adequately manage their tree. This is because once they are put “on notice” of the risk in this way, they are very much more likely to be held liable for any subsidence which does then occur. Recent legal cases such as Khan and Khan v London Borough of Harrow & Kane clarify that even without such notice, in some limited cases a homeowner can be held liable for subsidence damage caused by their tree anyway, but generally they would not be liable before specific notice had been properly given.

A professional risk assessment report should draw attention to the potential liability of the tree owner and to the requirement for them to notify their liability insurer (such insurance is usually given in most domestic contents policies at present) of the notification of risk they have been given. The insurer may well then put pressure on them to remove the risk – pointing out that if they chose not to act appropriately the insurer would not cover them in the event of a liability claim. Risk Assessment reports can be a very useful tool therefore in achieving overall reduction in risk, if acted upon.

by Bob Gibson – Subsidence Consultant (Structural Engineer & Building Surveyor)